Tauranga residents are having to spend nearly half of their earnings on mortgaging properties, according to a new report.

CoreLogic's latest report also highlights a decrease in house prices in Tauranga last month, hinting at a potential slowdown in property value growth.

The recent upward momentum in the New Zealand residential property market continued through February, according to the CoreLogic House Price Index (HPI).

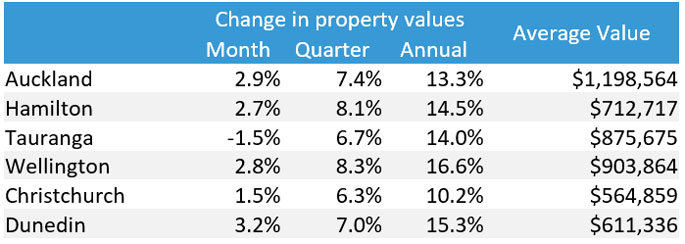

The HPI for February 2021 shows nationwide property values increasing by 2.6 per cent. This takes growth in the last 12 months to 14.5 per cent - a rate not bettered since the 14.8 per cent rise in the 12 months to October 2016.

However, the value of properties in Tauranga dropped slightly in February, by 1.5 per cent. The report suggests it is too early to consider this a continuing trend owing to the 6.7 per cent overall growth of the past three months.

The report also suggests Tauranga stands out when it comes to unaffordability of property.

Residents are spending 43 per cent of their average income to service a mortgage. This is the highest amount of the main centres in New Zealand.

With the loan-to-value ratio restrictions officially back in place from the start of the month and further tightening for investors from May, it's suggested that the current rate of property growth will ease over the coming months - as potentially already seen in Tauranga.

'This is especially likely following the Minister of Finance's direction to the Reserve Bank to ‘have regard to the impact of its actions on the Government's policy of supporting more sustainable house prices',” says CoreLogic's Head of Research Nick Goodall.

”While previously the RBNZ Governor, Adrian Orr, has expressed that the Bank has always done so, the latest communication is more explicit with regard to actively contributing to the government's housing policy objectives, namely reducing investor activity and improving affordability for first home buyers”.

Goodall explains further regarding mortgage applications.

'From a nationwide perspective banks have been busy assessing mortgage applications and ordering valuations for properties to lend on, but there are anecdotes of rushed applications to ‘beat the return of LVR restrictions' from banks outside the big four.

'Interestingly, mortgage advisors have stressed the importance of clear communication of the LVR limits as potential would-be buyers are put off due to the perception of requiring a 20 per cent deposit.

'This is because there is an allowance of up to 20% of new lending to be written with less than the standard 20 per cent deposit, as well as there being exemptions to the limits for new builds.”

7 comments

Scam

Posted on 04-03-2021 09:30 | By MountBorn

Due to low wages and high rip off prices both of us working ours was 43% things are so bad in nz we ended up selling and left the country

On and on and on!!!

Posted on 04-03-2021 09:39 | By The Professor

Stop going on about house prices, rental costs and debt to earnings!! House and rent prices are what they are and history dictates that these prices go up over time.....that will not change. People need to stop thinking they are entitled to a big house in an affluent area. House prices outside the main centers are not too bad and people will have to accept a commute to work. We also need more flats in areas bordering on to industrial areas, like those near Bayfair/Baypark....nothing wrong with those and they should be low cost.

@ The Professor

Posted on 04-03-2021 10:54 | By Yadick

How dare you try to take my right away from me to live in my mansion in an affluent area. Sitting in my full electric massage lazy boy with my big screen tv hooked up to my whoop-banging surround sound quadrphonoc stereo while sipping my mulled wine. Anyway I have to go, my V12 takes a little warming up before driving a whole block to town for my boutique shopping. PS. You are SO right. Totally agree with you.

Tom Ranger

Posted on 04-03-2021 11:14 | By Tom Ranger

@The Professor. But the govt says those houses are more than likely not up to "standard". lol Building inspections are proving too costly by themselves! Then when a buyer hears...Ohh...there is some work to be done. People just keep looking for the next one. First Home buyers need to to lower their expectations. Govt need to leave the "do me up" houses the hell alone and stop trying to save everyone! As a society we need to upskill so we can do a good portion of this kind of work ourselves. We also need more bloody builders as I've been saying since before Kiwi-build even started. No increase in builders and tradies. No increase in new houses. Simple equation really... I grew up with uncles and aunties that just got stuck in and did the plumbing, electrical etc themselves. Before what we have. Over-regulation of the building industry.

Nobody...

Posted on 04-03-2021 13:04 | By morepork

... should have to pay more than a third of their income for rent or mortgage, and ideally, it should be less than that. That is what is "affordable"... But if your aspiration is to a place like Yadick describes, then you will be paying much more. I understand there is a shortage of ANY housing for rental at the moment and I agree that the need there should be addressed better than it is. Prof is right; it IS a market, driven by supply and demand.

@Yadick

Posted on 04-03-2021 13:05 | By morepork

Great post... :-) Can I come and stay at your place, please?

@ morepork

Posted on 04-03-2021 14:08 | By Yadick

HAHAHA, you're WELCOME anytime at all. The doors always open, the coffees always on, the wines always there after 1800hrs . . . Just the house may not be quite as described and the car is more like a V1 than a V12.

Leave a Comment

You must be logged in to make a comment.