Home values in Tauranga continue to push upward in Tauranga at a rate of 7.5 per cent over the past three month period, with the average home is now valued at $1,197,798.

QV property consultant Derek Turnwald says the numbers of viewers at open homes and auctions had dropped off noticeably, but properties were still selling 'reasonably well”.

'Properties in the mid-to-high value range continue to sell fairly quickly, but the number of prospective buyers looking to purchase has decreased, with those who are actively looking to buy being in a better position to negotiate with vendors than they have been in previous months.

'Bank lending continues to be tightened, which has made it tougher for first-home buyers and people 55 years and older to get lending approved.

'This is having a dampening effect on value growth, as has been the growing number of listings that have been coming on to the market.

'Vendors appear to be sensing a ‘topping out' of the market and feel like now is the time to list.”

Nationally, residential property values continue to defy predictions of a collapse – although there are plenty of signs the market is starting to ease as we get through the first month of 2022.

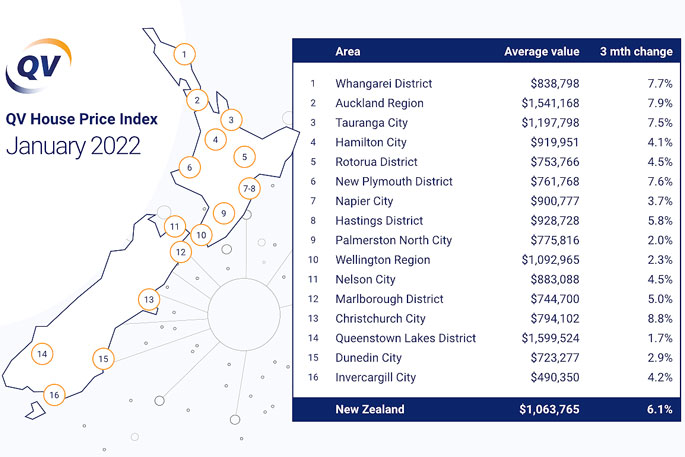

The average home increased in value by 6.1 per cent nationally over the past three-month period to the end of January, down from the 7.8 per cent quarterly growth we saw in December, with the national average value now sitting at $1,063,765.

This represents an average annual increase of 26.8 per cent, down slightly from 28.4 per cent annual growth last month.

In the Auckland region, the average value now sits at $1,541,168, climbing 7.9 per cent over the last three-month period, with annual growth of 27.6 per cent, down from the 29.1 per cent QV reported in December.

'We saw spectacular value growth throughout 2021, with increases we'll unlikely see again for a generation,” says QV General Manager David Nagel.

'But with interest rates on the rise, tightening credit conditions and supply pressures now easing, we'll likely see a property market return to a more sustainable level of growth.

'We've seen house listings surge in many locations where previously there was an acute lack of stock. And with the banks tightening their lending criteria in response to the new legislation, we've noticed a real falling off in auction and open home attendance.”

All 16 of the major urban areas QV monitors have shown a reduction in the rate of three-monthly value growth from the December data.

'This provides a pretty strong signal that value levels are peaking, as more vendors list their homes and the number of buyers reduce, especially first-home buyers and investors seeking bank credit,” says David.

'We're not seeing the double digit quarterly value growth we were used to seeing throughout last year, with Christchurch still leading the way at 8.8 per cent quarterly growth, a reflection of relatively affordable pricing of our second largest city.

'The annual rate of value growth is still exceptionally high though, reflecting the very strong value increases we saw last year. So that means it will take some time for this measure to reduce to more normal levels of growth.”

For the future, David says all eyes will be on the overseas response to the country's scheduled border reopening.

'If the floodgates were to open again to new migrants and returning Kiwis at the levels last seen in 2019, then we could see some strength return to the property market as demand for housing increases.

'But more likely we'll see a gradual decline in the rate of growth, as interest rates rise and tax deductibility rules take effect for investors, with only a few locations showing any significant reductions in value.”

2 comments

Lucky we have Labour

Posted on 11-02-2022 12:06 | By an_alias

All fluff and no actual help. Just like build 100k house, well ok they built 75.....it sure did help Labour.

Shortage of properties.

Posted on 11-02-2022 21:20 | By Ben Dover

Its all down to supply and demand and as long as there is the need to buy houses, property will be at a premium.

Leave a Comment

You must be logged in to make a comment.