The rate of house price growth is slowing, as tighter lending limits and changes to credit rules prevent some buyers from getting into the market.

The Real Estate Institute's house price index, which measures the changing value of property in the market, rose 19.9 percent in the year ended January to 4164.

However, this was a 1.5 per cent decrease from December and the index was down 2.6 per cent from its peak in November.

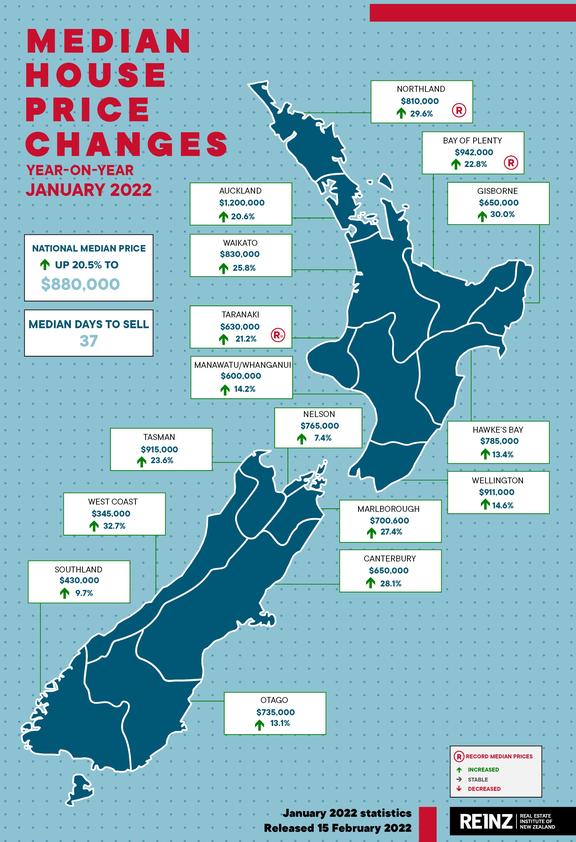

The national median house decreased 2.2 per cent month-on-month but is still 20.5 per cent higher than a year ago at $880,000. In seasonally adjusted terms, prices rose 1.4 per cent.

"While we do note a deceleration in the rate of price growth, it does follow a particularly strong year," says REINZ chief executive Jen Baird.

"Historically low interest rates and a supply deficit saw heightened demand and kept house prices rising through 2021.

"However, with the Reserve Bank increasing interest rates, inflation rates being at their highest in 30 years, tighter lending conditions, and government regulation, market dynamics are shifting."

The number of properties sold in January fell 28.6 per cent when compared with the same month a year ago.

In seasonally adjusted terms, sales were down 5.3 per cent.

At the same time, the number of properties available for sale increased 28.5 per cent to 19,897, as higher values enticed more people to sell.

Photo: Supplied / REINZ.

Photo: Supplied / REINZ.

Baird says it's normal to see sales slow in January but feedback from agents suggest that there are fewer first home buyers in the market with some pointing to recent changes to the Credit Contracts and Consumer Finance Act which had made it harder for some people to access credit.

"While hard evidence is lacking in terms of the impact of the CCCFA, data from Centrix, a New Zealand credit reporting agency, found the percentage of home loan applications that were approved dropped from 39 per cent in October to 30 per cent after December."

The longer-term effects would be seen in the number of buyers in the market in the coming months, says Baird.

"Looking forward, we would expect sales volumes to increase as we head into February and March."

The median number of days to sell a property across the country rose by two days to 37 days.

January saw 14.5 per cent of all properties sold by auction across the country, which is down from 15.6 percent the same month a year ago.

This is a substantial change compared to December, when auctions accounted for nearly a third of all sales.

"Anecdotally, feedback in the regions suggests that current prices and access to finance has seen fewer buyers in the market," says Baird.

0 comments

Leave a Comment

You must be logged in to make a comment.