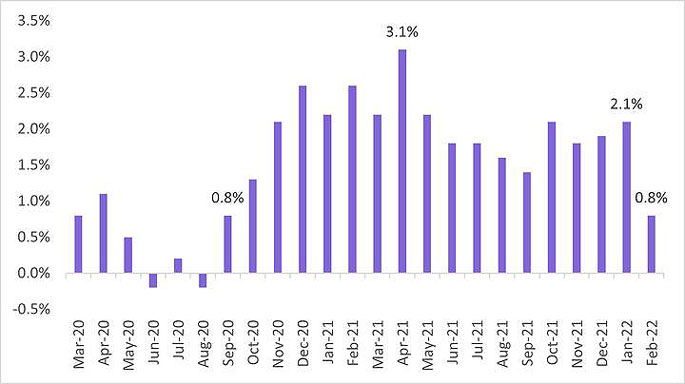

The property market is losing its strength as rising interest rates and stricter lending rules have resulted in house price growth fall to its lowest point in 18 months.

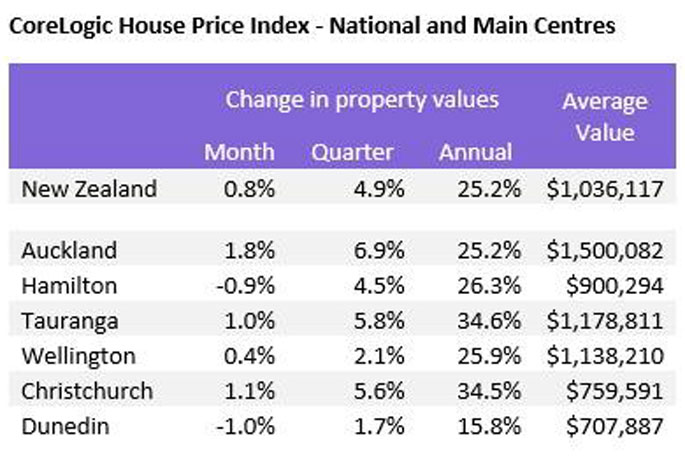

CoreLogic's House Price Index, which measures the changing value of property, rose 0.8 percent in February, taking the national average house price to $1.04 million.

It was a sharp drop on January's 2.1 per cent growth rate.

CoreLogic head of research Nick Goodall says it's the lowest rate of growth since September 2020, which marked the start of an exceptional 18-month growth phase.

Despite the growth, analysis of very recent sales showed sentiment was rapidly changing in the market, says CoreLogic.

Recent lending data from the Reserve Bank had revealed a significant drop in mortgage activity, despite more properties coming to market.

This was due to the higher costs of credit as the RBNZ hiked interest rates to rein in inflation, tighter lending restrictions, and controversial changes to the Credit Contracts and Consumer Finance Act (CCCFA), says Goodall.

The latter has been in operation since December but has already drawn severe criticism for causing people with previously good credit records to be refused finance.

"Our expectation is the HPI will dip further over the coming months as continued rate hikes and tighter credit controls weigh on market conditions."

Looking ahead, the government's review of the CCCFA changes may see credit conditions loosen, but for now, the outcome remained uncertain, he says.

The slowdown in lending means it's unlikely the Reserve Bank will introduce debt-to-income ratios this year.

The gradual reopening of the border means tracking net migration over the coming months will be important for the property market, says Goodall.

Demand could call further if the reports about an exodus of skilled workers relocating overseas come to fruition.

Regional breakdown

Photo: Supplied / CoreLogic.

Photo: Supplied / CoreLogic.Across the six main urban centres, house prices in Dunedin and Hamilton showed the greatest signs of weakness over February with price falling 1 per cent and 0.9 per cent respectively.

Growth in Wellington eased, gaining just 0.4 per cent over February.

Auckland saw the strongest lift in prices, rising 1.8 per cent with the average property value now $1.5m.

It was closely followed by Christchurch (+1.1 per cent) and Tauranga (+1 per cent).

House prices fell in seven of the 15 regional centres CoreLogic tracks.

0 comments

Leave a Comment

You must be logged in to make a comment.