The downturn in the housing market is unlikely to end any time soon, according to CoreLogic.

The property research firm's House Price Index, which measures changing values, shows prices fell 1.5 per cent over September, compared with a 1.8 per cent fall in August.

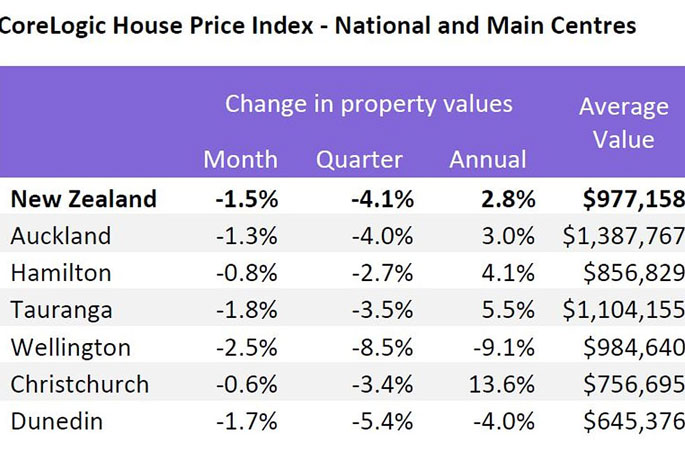

Annual house price growth slowed from 9.5 per cent in August to 2.8 per cent in September, with the average value at $977,158.

CoreLogic head of research Nick Goodall says the housing market is firmly in retreat after closed borders, low interest rates and fiscal stimulus helped to push prices up 41 per cent from August 2020 to March 2022.

"Despite the rate of decline easing in September, it's probably too early to suggest the housing market has moved through the worst of the downturn.

"With the OCR expected to increase a further fifty basis points (half a percent) to 3.5 per cent later today, that downwards pressure on house prices is likely to continue."

The tightness in the labour market and current resilient in economic activity could prompt the Reserve Bank to hike interest rates further into 2023 than anticipated, as it attempts to break the back of inflation, says Goodall.

The prospect of "more increases to come" means it might be premature to expect the end of housing downturn anytime soon, he says.

"That said, as long as unemployment remains low, the market is likely to be in an orderly correction rather than outright slump."

Regional breakdown

Property values fell across the six main centres in September, with Wellington seeing the most dramatic fall.

Photo: Supplied.

Photo: Supplied.Prices in the capital declined 2.5 per cent for the month, 8.5 per cent for the quarter and 9.1 per cent for the year.

"This is a record rate of fall for the region stretching back to 1990," says Goodall.

Auckland property prices slid 1.3 per cent last month to $1.39 million.

Looking to the country's other urban areas, prices dropped in all regions over September except New Plymouth and Queenstown, which recorded modest growth of 0.1 per cent and 0.4 per cent respectively.

"The Queenstown Lakes District continues to defy gravity and logic with values remaining 12.9 per cent above this time last year, no doubt boosted by the return of tourists and reflecting a distinct lack of land and properties in the adventure capital of the world."

Core Logic House Price Index - Other Main Urban areas:

(Change in property values by month, quarter, year and average value).

- Palmerston North -1.8% -3.5% -5.3% $689,609

- Napier -2.7% -6.5% -4.6% $804,837

- Hastings -4.5% -7.3% -3.4% $814,537

- Nelson -2.7% -5.7% 0.8% $812,967

- Whanganui -3.2% -5.6% 1.3% $530,029

- Invercargill -1.6% -2.1% 3.6% $462,319

- Rotorua -1.8% -3.5% 5.5% $692,512

- Gisborne -2.4% -4.0% 5.8% $629,650

- Whangārei -1.7% -5.1% 7.8% $800,136

- New Plymouth 0.1% -2.3% 8.6% $731,884

- Queenstown 0.4% -0.2% 12.9% $1,681,735

0 comments

Leave a Comment

You must be logged in to make a comment.