New Zealand's average home value has recorded its first annual reduction in more than a decade.

The latest QV House Price Index shows that home values have slipped by an average of 2.1 per cent nationwide in the 12 months to the end of September 2022.

It's the first annual home value reduction since June 2011, and marks nine straight months of declining home values nationally.

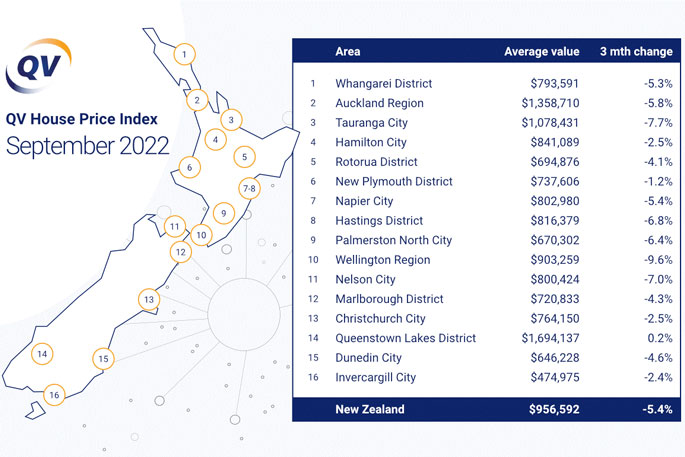

The average home decreased in value by 5.4 per cent nationally over the past three-month period to the end of September, just 0.1 per cent better than the rate of quarterly decline reported at the end of August, with the national average value now sitting at $956,592.

That figure is 9.2 per cent lower than at the start of this calendar year.

"The Reserve Bank's decision last week to raise the Official Cash Rate by another 50 points all-but ensures that the path we're on will continue for the foreseeable future," says QV General Manager David Nagel.

"Interest rate rises, credit constraints, the increasing cost of living – it's a sure-fire recipe for declining home values. Plus there are still new houses coming onto the market up and down the country, putting further downward pressure on prices almost everywhere.

"This will be worrying news for people looking to sell their homes, as well as those who purchased at the peak of the market now concerned about negative equity.

"The exceptional house price increases throughout 2020 and 2021 have impacted affordability and impeded access to the property market for most New Zealanders.

"This market correction, as painful as it is for some, will hopefully afford others an opportunity to get into the market in the future. Though it's still very tough out there for prospective first-home buyers, they're now gaining the upper hand when it comes to negotiations."

Across the main centres, Queenstown once again stands alone with 0.2 per cent quarterly home value growth, with all others continuing to succumb to tight credit conditions and rising interest rates.

The Wellington region's rate of quarterly home value decline almost hit double figures at 9.6 per cent last month, with Tauranga – one of a number of cities to also hit negative annual home value growth this month – its nearest competitor at 7.7 per cent.

In the Auckland region, the average value now sits at $1,358,710, falling 5.8 per cent over the last three-month period, with annual growth also descending into negative territory at 2.4 per cent, down from 1.1 per cent annual home value growth reported in the last QV House Price Index.

More than half of the Super City's districts are also now showing negative home value growth annually.

Of New Zealand's largest cities, Christchurch's residential housing market continues to demonstrate a greater degree of resilience than either Auckland or Wellington, with its annual rate of home value growth still looking comparatively rosy at positive 8.8 per cent.

The Garden City's average home value has reduced by 2.5 per cent this quarter to $764,150.

"The usual spring bounce in activity in the residential property market hasn't eventuated to the same degree as it has in previous years, but there are still plenty of active buyers out there, and deals are being done despite so much uncertainty.

"Large volumes of listings are giving purchasers plenty of choice and negotiating power, but it certainly looks as though sellers may still be in for a rough ride yet."

Tauranga has joined a growing list of New Zealand cities with negative annual home value growth.

It's the first time since September 2011 that Tauranga has recorded negative annual growth, with the latest QV figures showing that home values dropped by an average of one per cent in the 12 months to the end of September 2022, including a 7.7 per cent loss in the most recent quarter.

Tauranga's average home value is now $1,078,431 – still well above the national average home value, which is $956,592.

"Tauranga is still the least affordable city in New Zealand for housing in comparison to average wages. Even Aucklanders appear to be moving back to purchasing in their own market again, instead of purchasing here, as their market is gradually becoming more affordable again," says QV property consultant Derek Turnwald.

"Locally, many prospective buyers appear to still be holding off from making property purchases unless they find a property which is high in desirability or appears to be good value for money.

"Demand for housing of all values has declined as a result, with many vendors also withdrawing from the market and renting the property or remaining in the property until the market recovers.

"Economists are predicting that market values will make a slow recovery as they did post GFC. It seems that it will take people a while to gain confidence in the market again."

0 comments

Leave a Comment

You must be logged in to make a comment.