The downturn in the house market is deepening, with values expected to track down as interest rates continue to rise.

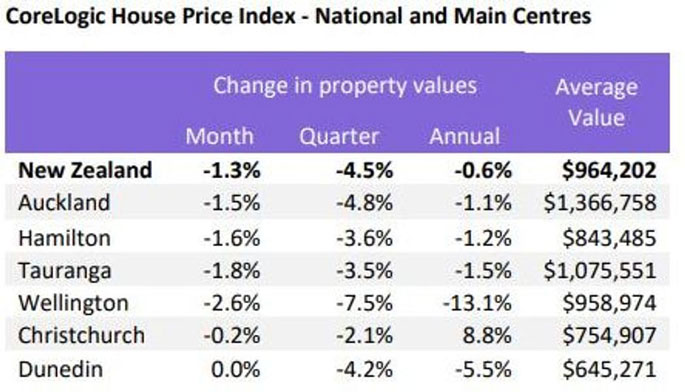

The CoreLogic House Price Index shows national house values fell 1.3 per cent in October over the month earlier, following a 1.5 per cent drop in September.

CoreLogic NZ head of research Nick Goodall says the biggest constraint on the housing market is affordability, with potential buyers stretched by rising mortgage interest rates and more stringent serviceability test rates.

"All banks have revised their house price forecasts down in the wake of the latest data and if we assume an 18 per cent fall from peak-to-trough, that would take the average price to $855,000."

While that was still higher than March 2020, the average pre-pandemic level was $723,000.

"To get back to that value would necessitate a 31 per cent fall - not something anyone is forecasting, yet," he says, adding a drop of that level will be unlikely given current economic conditions.

The Reserve Bank is expected to raise the official cash rate (OCR) later this month by perhaps 75 basis points, when it issues the next Monetary Policy Statement on November 23.

Goodall says annual inflation of 7.2 per cent in the third quarter has led to an across-the-board upward adjustment of OCR forecasts.

"Assuming the RBNZ follows suit on November 23, the OCR will move to 4.25 per cent, which could see the floating rate approach eight per cent and the one-year fixed-rate top six per cent."

Goodall says the average floating rate at the end of October was roughly 7.1 per cent, while the average one-year rate was 5.6 per cent, although some banks have already pushed one-year rates to 5.99 per cent.

"This will likely lead to a lot of belt tightening by mortgage holders - the exact desired effect the RBNZ wants."

Goodall says the serviceability test rate is already above eight per cent for at least one main bank and could lift to as much as 8.5 per cent as the OCR further increases to the OCR

"Furthermore, this market downturn continues to compare unfavourably to the last major downturn, following the Global Financial Crisis in 2008."

He says October's drop of 4.5 per cent was worse than the largest quarterly drop of 4.4 per cent seen at the end of August 2008, although current economic conditions are better now, with record low unemployment.

In addition, he says the annual rate of change had dropped 0.6 per cent into negative territory, which compares with the year earlier's annual record growth of 28.8 per cent, which will cushion the blow for most home owners, unless they bought in the past year.

"Stretched affordability is constraining the ability and willingness of all buyers to get or extend a mortgage, while property investors looking to grow their portfolio are also faced with tighter tenancy regulations alongside increasing costs and reducing rental growth."

He says the current conditions could mean the RBNZ shifts away from its current focus on containing inflation, given the deep impact its tightening monetary policy was having on the economy, employment and property values, however, it's unlikely in the near-term given the record high inflation.

"For now, the impact has been manageable and limited, but with each OCR hike comes a heightened risk of a deeper and longer recession and with it growing unemployment and financial stress.

"Time will tell whether the latest data releases and upcoming decisions and commentary will be enough to rein in spending and encourage more saving to produce a meaningful reduction of inflation - if not, the RBNZs job is going to get much more complicated."

0 comments

Leave a Comment

You must be logged in to make a comment.