The residential property market's downward trajectory continues as the end of the year draws near, with home values falling further from January to November than they have in more than 15 years.

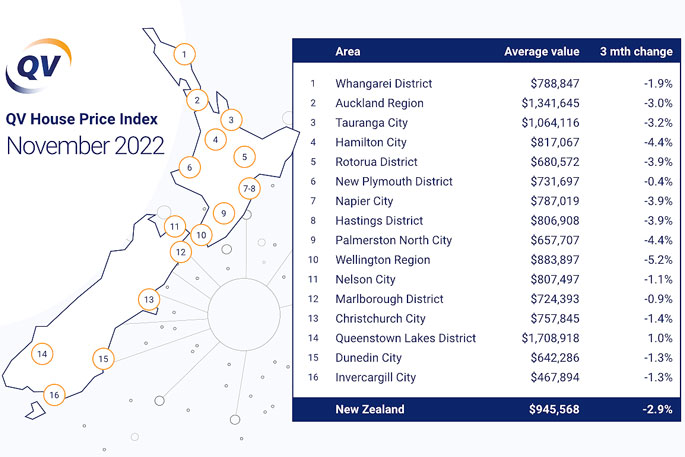

The latest QV House Price Index shows homes decreased in value by 2.9 per cent nationally over the three months to the end of November – a slight improvement on the 3.9 per cent quarterly reduction reported at the end of October – with the average value now sitting at $945,568.

With one month to go until the start of 2023, that figure is now 10.2 per cent lower, or $107,747 less in real dollar terms, than at the start of 2022.

The latest figures are a stark contrast to the same time last year, when the QV House Price Index showed values had climbed by an average of 25.5 per cent from January to November 2021.

In fact, the closest comparable year to this one is 2008, amidst the Global Financial Crisis, when home values fell by an average of nine per cent nationally from January to November, and 9.6 per cent total during the calendar year.

QV reports that home values continue to decline in Tauranga, albeit at a slower rate as we head into summer.

The average home value fell 3.2 per cent to $1,064,116 in the three months to the end of November, which is an improvement on the 5.8 per cent decline recorded in the October quarter.

With one month to go, the total decline this year to date is 9.3 per cent on average, which is a little better than the national average decline of 10.2 per cent.

QV property consultant Derek Turnwald says local real estate listing numbers have increased into summer, with open-home attendance also on the increase despite a general lull in demand.

'Many prospective buyers are still playing the waiting game, holding off making purchases unless they find the perfect property,” he says.

'Purchasers are taking longer to make up their mind than they have at any time since the pandemic began. Vendors are having to lower their expectations as there is greater room to negotiate prices, and properties with maintenance issues or unconsented work are proving very difficult to sell unless they're discounted significantly.”

'It's been a crazy couple of years in real estate with massive growth followed by a pretty significant correction,” says QV Chief Operating Officer David Nagel.

'The last time we saw anything similar to this was after the GFC in 2008, but that was an entirely different kettle of fish to what we're going through right now.

'For one thing, the market was behaving in a generally orderly fashion until that point, with gradual, sustainable growth – whereas the growth we saw during the first two years of the Covid-19 pandemic was far from gradual and sustainable.

'Home values increased by nearly 30 per cent nationally in 2021. In 2022, they've fallen by less than half that much on average, so there's clearly still some way to go until we're back at pre-pandemic levels.

'Fortunately, our economy hasn't taken a hit like it did in 2008, so unemployment remains very low – at least for now. Rising interest rates combined with an increase in the cost of living are going to continue to make life tough for many of us – especially the highly leveraged and those who purchased at the peak of the market.”

Of New Zealand's main urban centres, the largest home value drops so far in 2022 have occurred in Wellington (-18.7 per cent), Palmerston North (-14.5 per cent), Hastings (-12.5 per cent), Auckland (-12.2 per cent), Napier (-12 [per cent), Dunedin (-11.5 per cent), Hamilton (-11.3 per cent) and Tauranga (-9.3 per cent).

At 5.4 per cent, Queenstown is the only one still showing positive home value growth for the year, with Marlborough (-1.3 per cent), New Plymouth (-2.2 per cent) and Christchurch (-3.3 per cent) the next most resilient.

However, David says the latest QV House Price Index was not all doom and gloom for homeowners, with its rolling three-monthly rate of reduction slowing nationally for the fourth month in a row.

Besides Hamilton (-4.4 per cent) and Rotorua (-3.9 per cent), all of the main urban centres showed less negative home value growth on average this month than last.

Wellington (-5.2 per cent) saw the largest average decrease this quarter, and Queenstown was once more the only centre to show positive home value growth, albeit at just one per cent.

'The average rate of decline continues to slow in the lead-up to Christmas, despite the Reserve Bank's bumper rise in the Official Cash Rate last month.

'They've signalled further rises to look forward to next year, and with talk of a recession being bandied about now, we can expect further downward pressure on prices well into 2023 before we might eventually see the market bottom out later in the year.”

0 comments

Leave a Comment

You must be logged in to make a comment.