It has been a slow start to 2023 for Tauranga's beleaguered residential property market.

With activity down significantly on previous years, the average home value in Tauranga has slipped back 4.5 per cent to $1,028,268 since the start of January.

The city's three-month rolling average rate of decline has accelerated every month so far this year, with values now down 15 per cent year-on-year.

"Open home attendance is dropping off now as we head into cooler weather with only an average of three attendees per open home," says QV property consultant Derek Turnwald.

"Auction attendance is very poor, and consequently auction outcomes are also poor. Properties with maintenance issues or unconsented work are still very difficult to sell unless they are discounted significantly.

"Many frustrated vendors who are unable to reach an acceptable price are pulling their properties off the market, which is frustrating sales agents."

The residential property downturn appears to be gaining momentum once more, with home values making their largest first-quarter fall in more than 15 years.

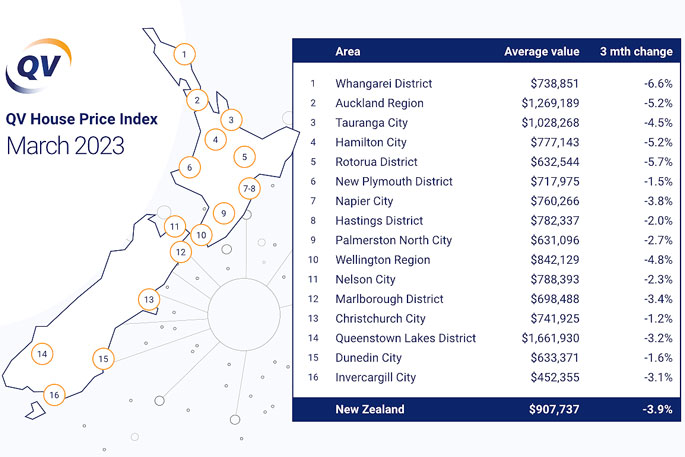

The latest QV House Price Index for March shows property values have decreased across Aotearoa New Zealand by an average of 3.9 per cent since the start of the year – weakening further from the 2.7 per cent three-monthly decline we saw in February, and the 1.7 per cent three-monthly decline recorded back in January.

The average home value is now $907,737, which is 13.3 per cent less than the same time last year.

It is a significantly larger first quarter decline than at the same time last year, when residential property values dropped by an average of 0.6 per cemt throughout the first three months of 2022.

In fact, the closest comparable start to a calendar year was in 2008, amidst the Global Financial Crisis, when home values dropped by an average of 1.1 per cent from January to March.

The latest QV figures show the rolling three-monthly rate of reduction increased last month in all bar two of the country's 16 largest urban areas, with the most significant quarterly home value reductions occurring on average in Whangarei (-6.6 per cent) and Rotorua (-5.7 per cent).

Of the largest cities, Auckland (-5.2 per cent), Hamilton (-5.2 per cent), and Wellington (-4.8 epr cent) led the decline.

Christchurch (-1.2 per cent) and Hastings (-2 per cent) were the two exceptions – the former experiencing the smallest decline of the main centres.

'Traditionally you don't see too many home value declines this time of year due to it being one of the busier periods for buying and selling real estate. But it's obviously a tough time right now for prospective buyers, who are having to deal with very significant credit constraints amidst an ongoing cost of living crisis,” says QV national spokesperson Simon Petersen.

'It's tough out there for sellers as well. With plenty of stock still available and fewer active buyers than normal, they're having to keep shifting their expectations downward to meet the evolving market. Interestingly real estate agents are reporting significant falls in new listings across the motu, which is an indication that most vendors are trying to tough it out until the market improves.

'In less than a year the average home value has fallen from $1m nationally to just a tick over $900,000 today. Now it looks destined to fall further still, especially following the Reserve Bank's latest increase to the Official Cash Rate, which should maintain that downward pressure on the housing market well into the cooler months of the year, when activity is traditionally even quieter.”

Simon isn't quite as pessimistic about the market's long-term prognosis.

'The good news is house prices are trending in the right direction for first-home buyers – now if only the same thing could be said of interest rates. Some are still predicting they could be pretty close to peaking. With increasing migration into the country only expected to increase demand for residential property, we might still see the downturn bottom out later in the year, but there's still so much uncertainty.

'There's still a possible recession looming large on the horizon, even more mortgage repricing to come, and no small matter of an election later in the year. It's little wonder that the market is so quiet right now. When the bottom of the market does finally come, we might even see the impact of some pent-up demand from the past year or so. Time will tell.”

2 comments

Keep going

Posted on 12-04-2023 07:13 | By TGA Local07

Very tough watching the news during covid and house prices just keep getting out of reach for young people… pushed out of their home towns. Very good for first home buyers but not so much for sellers… maybe invest in something productive instead of homes…..

Just the usual blip

Posted on 12-04-2023 16:45 | By The Professor

House prices will recover in time. Over decades, house prices increase and always will. Hang in there homeowners - if you don't need to sell, don't. Restricting the inventory will push the prices up again. We need cheaper houses built in cheaper areas. Too many people think they have the right to live where their parents brought them up. Sometimes we don't always get what we want in life. There are cheaper areas in NZ....it may mean moving.

Leave a Comment

You must be logged in to make a comment.