Tauranga City's average home value has reduced by 7.2 per cent throughout the first six months of 2023 to reach $998,727.

It's the first time since April 2021 that Tauranga's average home value has been less than $1 million.

The latest QV House Price Index's quarterly rate of reduction slowed from four per cent in May to 2.9 per centin June, which QV property consultant Derek Turnwald says is another indication that the residential market is close to its low point.

'Sales turnover is starting to increase and value declines are decreasing.

'First-home buyers are realising that the market is reaching the end of its decline and are showing stronger interest. Banks are beginning to relax a little with loan application scrutiny, and as of June 1 the Reserve Bank has relaxed its loan-to-value ratio criteria slightly.

'Investors are starting to show some interest in the market again, as many of them will also be sensing that the market is close to bottoming out.

'Although many will still likely wait to see if we have a National government take power later this year to change some of the tax laws that the current government put in place to make investment property ownership less attractive.

'There has been a recent increase in building company failures and building delays, which is likely to be discouraging some people from undertaking new builds.

'These people will likely look to purchase from the existing housing stock, leading to an increase in activity.”

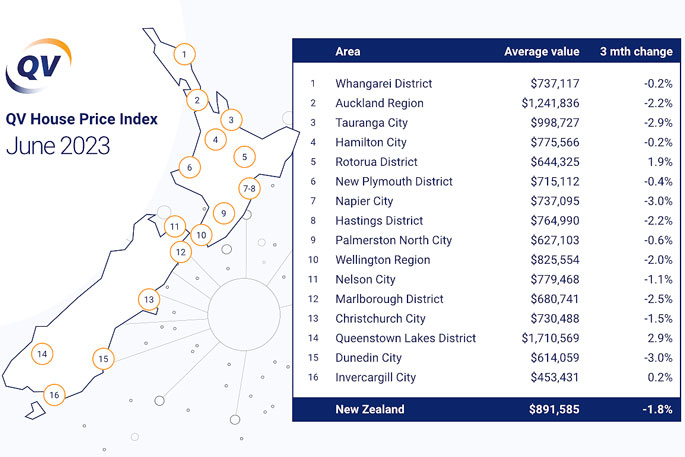

The QV House Price Index for June 2023 shows the average home decreased in value by 1.8 per cent nationally this quarter, a smaller rate of decline from the 3.4 per cent decrease in quarterly value change experienced back in May.

The national average home value is now $891,585, which is 11.8 per cent lower than the same time last year and 5.6 per cent less than at the start of this calendar year.

'Low sales volumes continue to result in significant volatility in key housing metrics, so we're continuing to see short-term spikes in monthly value changes around the country,” says QV operations manager James Wilson.

'For example, in the recent numbers, Auckland's rate of softening increased from last month. This volatility is likely to continue for a while yet, with the rate of reduction continuing to leap and fall accordingly, but the stats do continue to suggest that value falls are generally flattening overall.”

The latest QV figures show the average quarterly rate of home value decline has slowed in all but two of the country's 16 largest urban areas – Hastings (-2.2 per cent) and Dunedin (-three per cent) – with Rotorua (1.9 per cent), Queenstown (2.9 per cent) and Invercargill (0.2 per cent) recording positive growth for the three months ending June 30, 2023.

Values also reduced at a faster than average rate in Auckland (-2.2 per cent), Wellington (-two per cent) and Tauranga (-2.9 per cent), where the average home has now dropped below $1 million.

James says parts of the country that have relatively low average home values are typically outperforming the more expensive areas, with Queenstown being the obvious exception.

'This is a result of who has been most active in the market, with first-home buyers continuing to make up a larger share of the market overall. As a result, a higher proportion of lower priced properties are being represented in sales activity, while investors and ‘movers' remain generally cautious.

'Anecdotally we have been hearing reliable reports from real estate agents and our registered valuers around the country that growing numbers of investors are beginning to re-enter certain locations that they view as offering good value for money – but this is not yet a widespread trend while such strong economic headwinds continue to lash the country.

'We are now well on the cusp of the next refinance wave with many households still having to re-fix at significantly increased mortgage rates.

'While we haven't yet seen signs of defaults or mortgages under duress increasing to significant levels of alarm, spending levels and recent data on household savings rates would indicate that belts have been tightened across NZ and more disposable income is being funnelled towards interest servicing.

'This will maintain downward pressure on the market for the time being, even as increasing demand for housing continues to build up in the background.”

1 comment

Rates up then

Posted on 11-07-2023 12:14 | By an_alias

This wont change your ever increasing rates, the un-elected see no end to what they can spend. For some strange reason we used to have spending limits but not the un-elected.

Leave a Comment

You must be logged in to make a comment.