Homes in Tauranga are worth one per cent less on average than they were three months ago.

The QV House Price Index for May 2024 shows the city’s average home value reduced by one per cent to $1,030,608 this quarter – down from a three-month average rolling rate of 0.2 per cent growth in our April 2024 index.

However, Tauranga’s average home value is still 2.6 per cent higher than at the same time last year.

New Zealand Aotearoa has just recorded its first quarterly home value reduction since July last year – albeit a modest one.

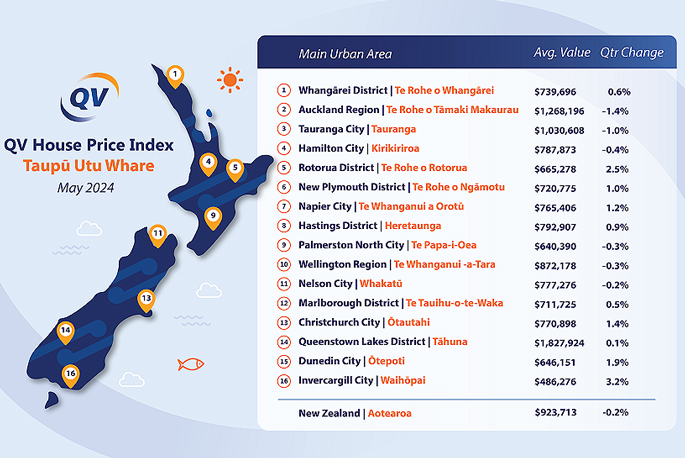

The latest QV House Price Index shows home values decreased by an average of 0.2 per cent nationally over the three months to the end of May 2024 – down slightly from the 0.1 per cent quarterly growth reported for April – with the average value now sitting at $923,713.

That figure is 3.9 per cent higher than the same time last year and 13.2 per cent ($140,052) lower than its peak in late 2021.

The average rate of home value growth either decreased, or the rate of decline increased, in nearly all of the main urban areas we monitor.

However, all of the reductions were relatively modest, with Auckland leading the reductions with a 1.4 per cent average home value deficit this quarter – marking four straight months of negative growth.

Wellington (-0.3 per cent) also recorded its first average quarterly home value reduction since the end of winter last year. Tauranga (-1 per cent), Hamilton (-0.4 per cent), Palmerston North (-0.3 per cent), and Nelson (-0.2 per cent) all experienced similarly small quarterly declines.

At the other end of the spectrum, and the country, Invercargill recorded the largest amount of home value growth at 3.2 per cent for the May quarter. Rotorua (2.5 per cent), Christchurch (1.4 per cent), and Dunedin (1.9 per cent) also recorded notable, yet still relatively modest, quarterly gains.

"Home values continue to bobble up and down from month to month and quarter to quarter, but they aren’t moving one way or the other with any real conviction," says QV operations manager James Wilson.

"The housing market has largely stalled, and now the seasonal slowdown is well and truly upon us, with both buyers and sellers continuing to grapple with difficult economic conditions.

"Against this challenging backdrop, an excess of housing stock on the market is maintaining downward pressure on prices. So those who are in a position to buy right now, have the upper hand. Purchasers are spoilt for choice and appear to have time on their side, with nothing to suggest that house prices are going to take off again soon.

"Of course, saving a sizeable deposit for a home and getting pre-approval from the bank is no mean feat in this environment, with the axing of the First Home Grant scheme also increasing the odds of home ownership for some first-home buyers."

This is among a raft of recent regulatory changes that will impact the property market this year.

From July 1, banks will have to comply with new debt-to-income restrictions that will limit the amount of debt that borrowers will be able to take on, relative to their income.

At the same time, loan-to-value ratios will be loosened, and the bright-line test will also be shortened to two years.

Despite all this, James still expects the market to stay flat to gently softening throughout winter.

"Property owners might look at our latest figures and start getting that sinking feeling again. While first-home home buyers might even look at them with renewed optimism.

"But the reality is a market that is stuck between a rock and hard place, at least until mortgage pressure eventually lifts.

"We may see more listings come onto the market due to the changing bright-line test restrictions, which will offer buyers even more choice.

"Otherwise higher mortgage rates are already severely restricting buyers, so changes to DVRs and the introduction of DTIs won’t have a material effect in the short to medium term. Interest rates remain the dominant restraining factor."

1 comment

My Valuation went down

Posted on 14-06-2024 12:07 | By Paul W2

I bought a house here in Tauranga in April last year. We got the new council valuation a couple of months ago and find that it has gone down by $90 grand but I notice the rates have still gone up and thanks to the TCC saying I live on a possible slip plain my insurance premium per month has gone up by $100 per month

Leave a Comment

You must be logged in to make a comment.