April has brought a further slowdown in sales activity, more moderate price growth and, as properties stay on the market for longer, it appears favourable to buyers backed by equity.

This is according to the latest data and insights from the Real Estate Institute of New Zealand.

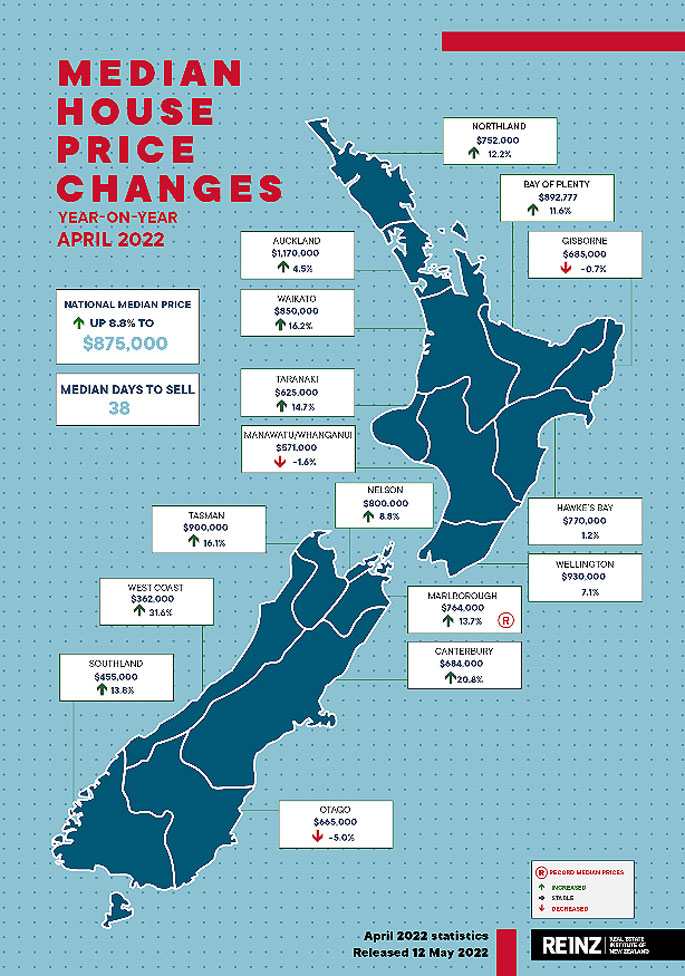

Bay of Plenty's median house price increased 11.6 per cent from April 2021 to $892,777. Inventory levels saw a significant increase in April of 116.5 per cent year-on-year.

Listings also had a 21.8 per cent increase — displaying a market of supply outweighing demand.

Across New Zealand, the number of residential property sales decreased annually by 35.2 per cent in April 2022, from 7497 in April 2021 to 4860.

The sales count for New Zealand excluding Auckland, decreased 31.7 per cent annually from 4815 to 3287.

Month-on-month, there was a 29.3 per cent decrease in sales count for the country.

REINZ expects sales numbers to fall in the month of April as March is typically one of the stronger months in the annual property market cycle.

So, while the nominal change is significant, the seasonally adjusted figures for New Zealand show a decrease of 0.9 per cent moving from March to April — only a marginally weaker result than usual for the month.

Looking at the seasonally adjusted figures over time, the pace of the market change is stark. Through mid-2021, the seasonally adjusted month-on-month sales count was negative due to low levels of supply and high demand. After a stronger than expected October, it returned to negative seasonally adjusted figures — this time marking the introduction of the CCCFA changes and growth in available stock — shifting the market from one underpinned by high demand (2021) to one of high supply (2022).

All regions saw an annual decrease in the number of sales; those with the greatest annual percentage decrease were:

• Marlborough, which decreased 53.6 per cent annually from 84 to 39

• Auckland, which decreased 41.3 per cent annually from 2,682 to 1,573

• Hawke's Bay, which decreased 39.2 per cent annually from 209 to 127

• West Coast, which decreased 38.3 per cent annually from 47 to 29

Excluding lockdown influenced April and May 2020, this was the greatest annual percentage decrease in sales in Marlborough since July 2020, Wellington since January 2009 (down 34.6 per cent annually to 515), and Northland since June 2017 (down 36.9 per cent annually to 142), says REINZ chief executive Jen Baird.

'We're now in the phase of the property cycle where demand has weakened, sale counts are down but prices remain high. We're seeing a slowdown in activity, there is more stock staying on the market for longer, and while annual price growth is more moderate, the month-on-month trend shows a fall in median prices.

'April residential property sales decreased annually by 35.2 per cent across New Zealand, a story reflected across all regions. Looking at the underlying reasons for the continued decrease in sales count, the seasonally adjusted figures provide some insight. Last year sales volumes were underperforming due to supply challenges, and post-October 2021 when we began to see an influx of stock, it became a market underperforming due to demand challenges.

'Falling attendance at open homes and auction rooms, and a decrease in buyer enquiries were reported across New Zealand — exacerbated by a spate of public holidays through April. Affordability, uncertainty and changing financial conditions remain primary concerns. Tighter lending criteria, LVRs, and increasing interest rates coupled with inflation continue to create challenges for some buyers — particularly first home buyers and investors.

'Those who are backed by equity and secure in a job market with a low unemployment rate, will continue to see opportunity in the market as more stock increases choice, and prices ease. Owner-occupiers are the most present and active in the market, so while we see a softening in the mid to low price range, interest is solid in the mid to high bracket.

'Increases to the OCR, most recently by 0.5 per cent in April, have further impacted affordability, and with the cost to own increasing, property may seem less attractive. With a forecast peak of over 3.0 per cent, some potential buyers may hold off purchasing in a market where interest rates are likely to rise.

'For those who purchased property over recent years, these increases were largely expected and factored into banks' requirement for borrowers to be able to service mortgage increases — providing a buffer for most. The challenge will be for those re-fixing their mortgage.”

0 comments

Leave a Comment

You must be logged in to make a comment.