The QV House Price Index for July shows the housing market correction is beginning to bite across most of New Zealand, with rising interest rates, credit constraints and inflationary pressures causing the national average home value to drop below $1,000,000 for the first time since September 2021.

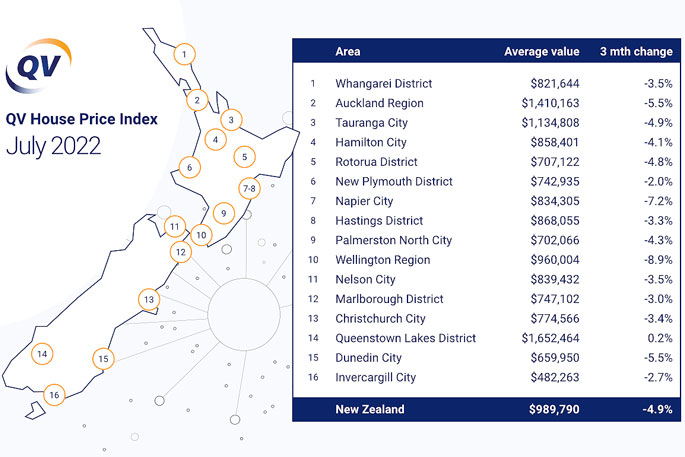

The average home decreased in value by 4.9 per cent nationally over the past three-month period to the end of July, with the average value nationally now sitting at $989,790.

In the Auckland region, the average value now sits at $1,410,163, falling 5.5 per cent over the last three-month period, but it is in the Wellington region where the residential property downturn is hitting the hardest. The average value in Wellington city is down almost 11 per cent over the quarter.

In Tauranga, home values have dropped by an average of 4.9 per cent this quarter – the same rate of reduction as the national average.

It's a marginal increase from the quarterly rate of negative home value growth we reported for June (-3.5 per cent), with the average home value now sitting at $1,134,808 – well above the national average ($989,790). Values are still 8.5% higher on average than at the same time last year.

"WIth high inflation and the rising cost of living, prospective purchasers are taking much longer to deliberate over purchasers, holding off until they find the perfect property or a vendor who is willing to negotiate," says QV property consultant Derek Turnwald.

"Though the market remains largely subdued at present, first-home buyers are beginning to show some renewed enthusiasm, but for most it's a struggle to save a large enough deposit.

"Considering the current degree of economic volatility, it seems unlikely that prices will stabilise in the short term."

In the meantime, "low population growth and a loss of young people overseas now the borders are open might allow the supply of dwellings to catch up with demand".

Image: QV.

Image: QV.

QV Operations manager Paul McCorry says the reduction in annual growth across the country is staggering.

"The almost 30 per cent national growth we were reporting at the turn of the year is now down to just four per cent, and that is only half the story.

Locations such as Wellington, Palmerston North and Dunedin, which saw such meteoric increases in mid to late 2021, have had those capital gains wiped out and are now into negative growth over 12 months – the first time in a decade this has happened in Dunedin.”

Wellington city is leading the charge, where in real terms, the average home value has dropped by more than $130,000 in only a quarter.

It is not just confined to the city either – suburban areas such as the Hutt Valley and Porirua have also seen values drop between 7-9 per cent over the last three months.

"While those numbers seem jaw dropping, it's no surprise that the areas that saw the fastest gains towards the peak at the end of 2021 are now seeing the sharpest declines.

"One of the few exceptions is Christchurch, which had seen almost 40 per cent annual growth by the later months of 2021, but is now only seeing relatively moderate declines of 3.4 per cent for the quarter."

A symptom of the last major market correction, the Global Financial Crisis in 2008, was high volumes of mortgagee transactions, but McCorry speculated that such a widespread trend is unlikely to occur in the current market.

"Following the GFC, mortgagee sales were common as job security was weakened and serviceability became an issue. If there were a lot of mortgagee sales, this current market correction could well tumble into a crash.

"But the most recent unemployment statistics, nudging up only marginally to 3.3 per cent, demonstrates just how tight the labour market is, which is also supporting some wage growth. So unless there is a dramatic shift in unemployment, it seems improbable that this will happen in 2022, even with higher interest rates."

In addition to a strong labour market, he said Loan-to-Value ratios are now performing as they have been designed to.

"Stringent LVR restrictions were much maligned by first-home buyers over the last few years but the insulation blanket of a 20 per cent deposit required by the Reserve Bank is now serving its purpose."

Meanwhile, Queenstown-Lakes District remains an outlier as the only one of the 16 major centres QV monitors that has had positive growth over the last three months, albeit only just at 0.2 per cent.

McCorry suggests the region will continue to buck the trend.

"With the complete removal of all border restrictions as of the end of July, the obvious benefactor will be the tourist capital of the country.

"With increased tourism, the demand for accommodation for hospitality and tourism workers will return, which could be a boost for property investors in the region, as well as breathing some much needed air back into the local economy.

"Now how we track nationally over the next three months will largely depend on the Reserve Bank announcement on the OCR later this month.

"We've seen four successive 50 basis point increases since February and little sign of an arrest in the rate of inflation – any further increases will only fan the flames of this correction further."

2 comments

So?

Posted on 09-08-2022 07:48 | By The Professor

The house values will go over a million again in the near future, and will stay above one million. they will eventually hit two million given time. This is a normal cycle - up and down, up and down. Houses are more expensive now than 20 years, 30 years, 100 years ago. Values always trend upwards and that won't change.

The 'headline grabbers'...

Posted on 09-08-2022 19:46 | By groutby

.... have been so desperate to be able to report of a market 'crash' that some reporting seems quite exaggerated, and only of late the 'expert economists' are finally admitting they don't really know which way the economy will go either, as The Professor says, human behaviour will decide the way forward, the market will prevail whichever way that may be....

Leave a Comment

You must be logged in to make a comment.