One month in and QV operation manager James Wilson says 2025 is already shaping up to be an intriguing year for the housing market – though you wouldn’t necessarily know it from looking at the latest figures.

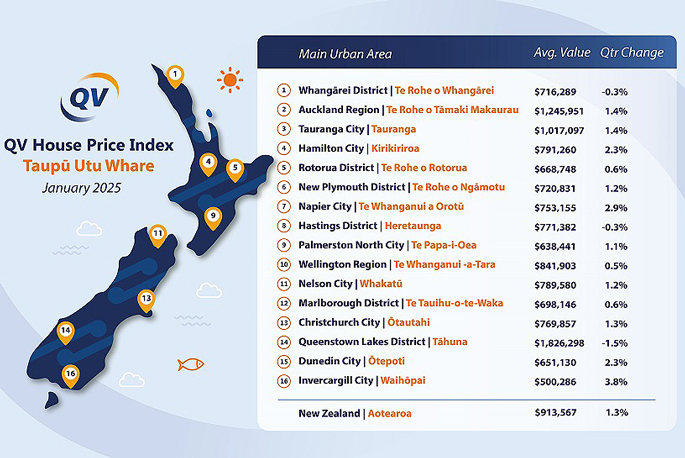

The most recent QV House Price Index shows residential property values have once again increased slightly, edging upward by an average of 1.3% nationally in the January quarter.

The average home is now worth $913,567, which is just 1.3% less than the same time last year and 14.1% below the market’s peak in late 2021.

It hasn’t been the hottest start to summer for Tauranga’s housing market.

Home values have increased by an average of just 1.4% this quarter.

The city’s average home value is now $1,017,097, which is 1.1% less than the same time last year.

Meanwhile, average home values have also increased this quarter in Rotorua (0.6%), Whakatāne (1%) and especially Ōpōtiki (2.2%).

The latest QV House Price Index shows that residential property values have once again increased slightly. Image: Supplied

“On the surface, we’re seeing a continuation in 2025 of the overwhelmingly flat theme that we saw throughout much of last year.

“This is to be expected, given the economic factors at play – namely high interest rates and credit constraints, sustained weakness in the labour market, and an oversupply of properties available for sale.

“However, we are also seeing less home value reductions now and what little growth there is does appear to be trending ever so slightly upward. At the same time, mortgage rates are falling and property sales volumes are building, which could pave the way for more substantial growth later this year.

“That won’t happen overnight, of course, but we will be actively monitoring this space with interest – as I’m sure many sellers, purchasers and investors will be throughout 2025.”

Of the main urban areas QV monitors across Aotearoa New Zealand, only three have recorded modest reductions this quarter – Whangārei (-0.3%), Hastings (-0.3%), and Queenstown (-1.5%). Auckland (1.4%), Hamilton (2.3%), Tauranga (1.4%), Napier (2.9%), Dunedin (2.3%) and especially Invercargill (3.8%) all recorded above-average increases in home value during the three months to the end of January 2025.

“Value strengthening across these main urban areas throughout the summer has propped up the nationwide results to some degree, with increased competition among buyers helping to stabilise and slowly strengthen home values,” said Wilson.

However, he pointed out that there had also been an “uptick” this year in the number of properties available for sale across most centres nationwide, providing buyers with ample choice.

“Summer is traditionally the peak season for buying and selling, so it’s unsurprising to see more buyers and sellers in the market, especially as economic circumstances improve.

“What will be interesting to see is how long it takes for this excess stock to be absorbed, because that’s when we will see demand start to push prices up in a more substantial way.

“Once again, this will not happen overnight, but further interest rate reductions will certainly quicken the process.

“For now, the cost of borrowing remains relatively restrictive, and the economy and therefore the job market is still doing it tough.

“Investors and owner-occupiers are showing increasing interest in the property market but remain cautious overall, while first-home buyers are continuing to make up a larger proportion of the market in the meantime.”

0 comments

Leave a Comment

You must be logged in to make a comment.